The Evolving Landscape of GST on smartphones in India: A Comprehensive Analysis

The Goods and Services Tax (GST) regime, implemented in India on July 1, 2017, has significantly impacted various sectors, including the dynamic smartphone industry. The taxation of smartphones, a product now considered an essential commodity, has undergone several changes, reflecting the government’s efforts to balance revenue generation with consumer affordability and the “Make in India” initiative. This article delves deep into the intricacies of GST on smartphones in India, examining its evolution, impacts, and future prospects.

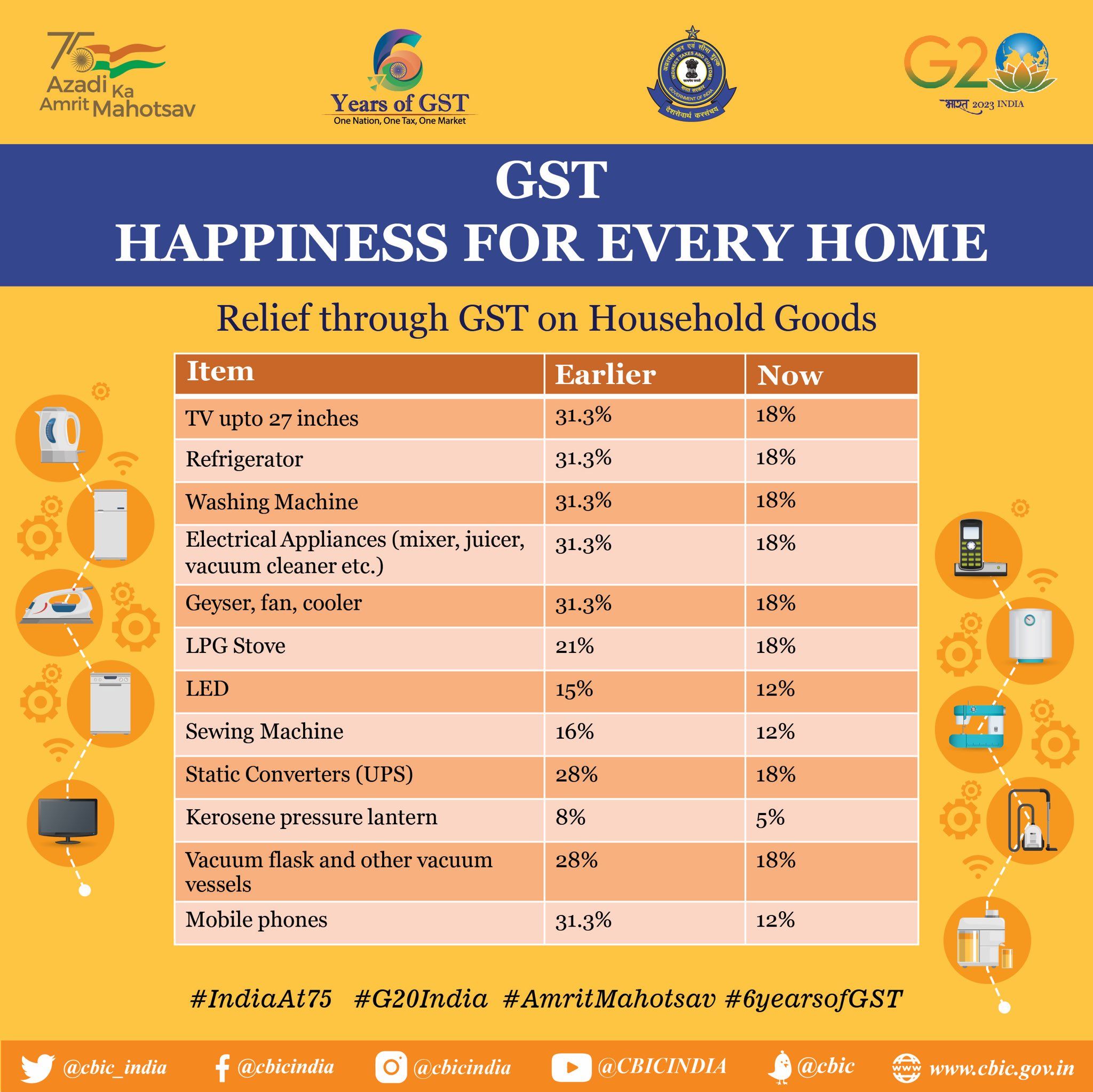

The introduction of GST aimed to simplify the complex indirect tax structure prevalent in India, replacing multiple taxes like excise duty, VAT, and service tax with a unified tax. Initially, smartphones fell under the 12% GST slab, a rate considered relatively moderate. This initial rate was intended to encourage wider adoption of smartphones, especially in rural areas, and to support the burgeoning digital economy.

However, in 2018, the GST Council revised the rate for smartphones to 18%. The rationale behind this increase was multifaceted:

Revenue Augmentation

The government aimed to boost revenue collection, considering the rapidly expanding smartphone market and its substantial contribution to the economy.

Alignment with Other Electronic Goods

The 18% rate aligned smartphones with other electronic devices, creating a more uniform tax structure across the sector.

Promoting Domestic Manufacturing

The increased GST was also intended to incentivize domestic manufacturing of smartphones under the “Make in India” initiative. By making imports more expensive, the government aimed to encourage local production and reduce reliance on foreign imports.

The immediate impact of the 18% GST was a rise in smartphone prices, affecting consumer affordability, particularly in the budget segment. While major brands absorbed some of the cost increase, the overall price hike was passed on to consumers.

Specifically, the gst council made the change from 12% to 18% in the year 2020, and then it took effect on the 1st of april 2020. This change was finalized in the 39th gst council meeting.

Consumer Impact: Price Sensitivity and Demand

The price increase significantly impacted consumer behavior, especially in price-sensitive segments. Consumers became more cautious with their purchases, leading to a temporary slowdown in demand for budget and mid-range smartphones.

Manufacturer and Retailer Adjustments

Manufacturers and retailers had to adapt to the new tax regime by adjusting their pricing strategies and optimizing supply chains. They also focused on promoting value-added features and enhancing customer experience to justify the higher prices.

Impact on the “Make in India” Initiative

The impact on the “Make in India” initiative was mixed. While it provided an incentive for domestic manufacturing, it also increased the cost of components, affecting local manufacturers’ competitiveness.

The GST regime impacts the entire smartphone ecosystem, from component manufacturers to retailers and consumers.

Component Manufacturing and Imports

The GST rate on smartphone components influences the overall cost of production. Complexities arise from differing GST rates for various components and the challenges of claiming input tax credit.

Distribution and Retail

Distributors and retailers face challenges in managing GST compliance, including invoicing, filing returns, and claiming input tax credit. The need for efficient inventory management and accurate tax records becomes paramount.

Online Sales and E-commerce

The surge in online smartphone sales has added another layer of complexity to GST compliance. E-commerce platforms must ensure accurate tax collection and compliance with state-specific regulations.

The smartphone industry in India is dynamic and rapidly evolving. As technology advances and the market matures, the government needs to refine the GST policy to address emerging challenges.

Rationalization of GST Rates

A review of the 18% GST rate could be considered, especially for budget smartphones, to enhance affordability and promote digital inclusion.

Simplification of Compliance Procedures

Simplifying GST compliance procedures for small and medium-sized retailers and manufacturers would reduce the burden and promote ease of doing business.

Promoting Domestic Manufacturing

Strengthening the “Make in India” initiative by providing incentives for local component manufacturing and research and development would boost the sector’s growth.

Addressing the Grey Market

Addressing the issue of the grey market, which evades taxes and harms legitimate businesses, requires stricter enforcement and improved monitoring mechanisms.

Smart phone sales and usage have a wide economic impact.

Telecom Sector.

Smartphones are integral to the telecom industry. GST implications effect data usage, and the selling of data plans.

E-commerce.

A large amount of E-commerce sales occurs on smartphones, or of smartphones themselves. Tax effects sales number, and online retail business strategies.

Software Development.

Application development and related software industries heavily depend on the volume of smartphone usage.

Smartphones play a pivotal role in promoting digital inclusion, particularly in rural and underserved areas.

Bridging the Digital Divide

Making smartphones more affordable would enable wider access to digital services like education, healthcare, and financial services.

Empowering Rural Communities

Digital literacy and access to information through smartphones can empower rural communities and contribute to their economic and social development.

Supporting Digital India Initiatives

The government’s Digital India initiatives, such as digital payments and online governance, rely heavily on smartphone adoption.

Analyzing the GST or VAT rates on smartphones in other countries can provide valuable insights.

Developed Economies

Many developed economies have lower VAT rates on electronic goods, including smartphones, to encourage consumer spending and technological adoption.

Developing Economies

Some developing economies have higher VAT rates to generate revenue, but they also offer incentives for local manufacturing.

Regional Variations

Regional variations in tax rates and regulations exist even within countries, highlighting the need for a nuanced approach.

The future of smartphones and GST in India will be shaped by several emerging trends.

5G and Advanced Technologies

The rollout of 5G and the adoption of advanced technologies like artificial intelligence will create new opportunities and challenges for the smartphone industry and the GST regime.

Evolving Consumer Preferences

Changing consumer preferences, such as the growing demand for premium smartphones and foldable devices, will necessitate adjustments to the tax structure.

Sustainability and Environmental Concerns

Increasing environmental concerns will drive demand for sustainable smartphones, requiring manufacturers and the government to adopt eco-friendly practices.

The GST on smartphones in India has undergone significant changes, reflecting the government’s efforts to balance revenue generation, consumer affordability, and the “Make in India” initiative. While the 18% GST rate has contributed to revenue growth, it has also impacted consumer affordability, particularly in the budget segment. Moving forward, the government needs to adopt a balanced approach, considering the evolving dynamics of the smartphone industry and the broader goals of digital inclusion and economic development. A policy that harmonizes tax revenue collection with the encouragement of local manufacture, and keeping devices affordable for the masses, would prove to be the most benificial.